Blog

Busting the Biggest Myths About Down Payments

Buying a home is exciting… until you start thinking about the down payment. That’s when the worry kicks in:

“I’ll never save enough.”

“I need a small fortune just to get started.”

“I guess I’ll just rent forever.”

Sound familiar? You’re not alone—and you’re definitely not out of luck.

The truth is, a lot of what you’ve heard about down payments just isn’t true. And once you know the facts, you may realize you’re a lot closer to homeownership than you think. Let’s bust a few of the biggest myths.

Myth 1: “I need to come up with a big down payment.”

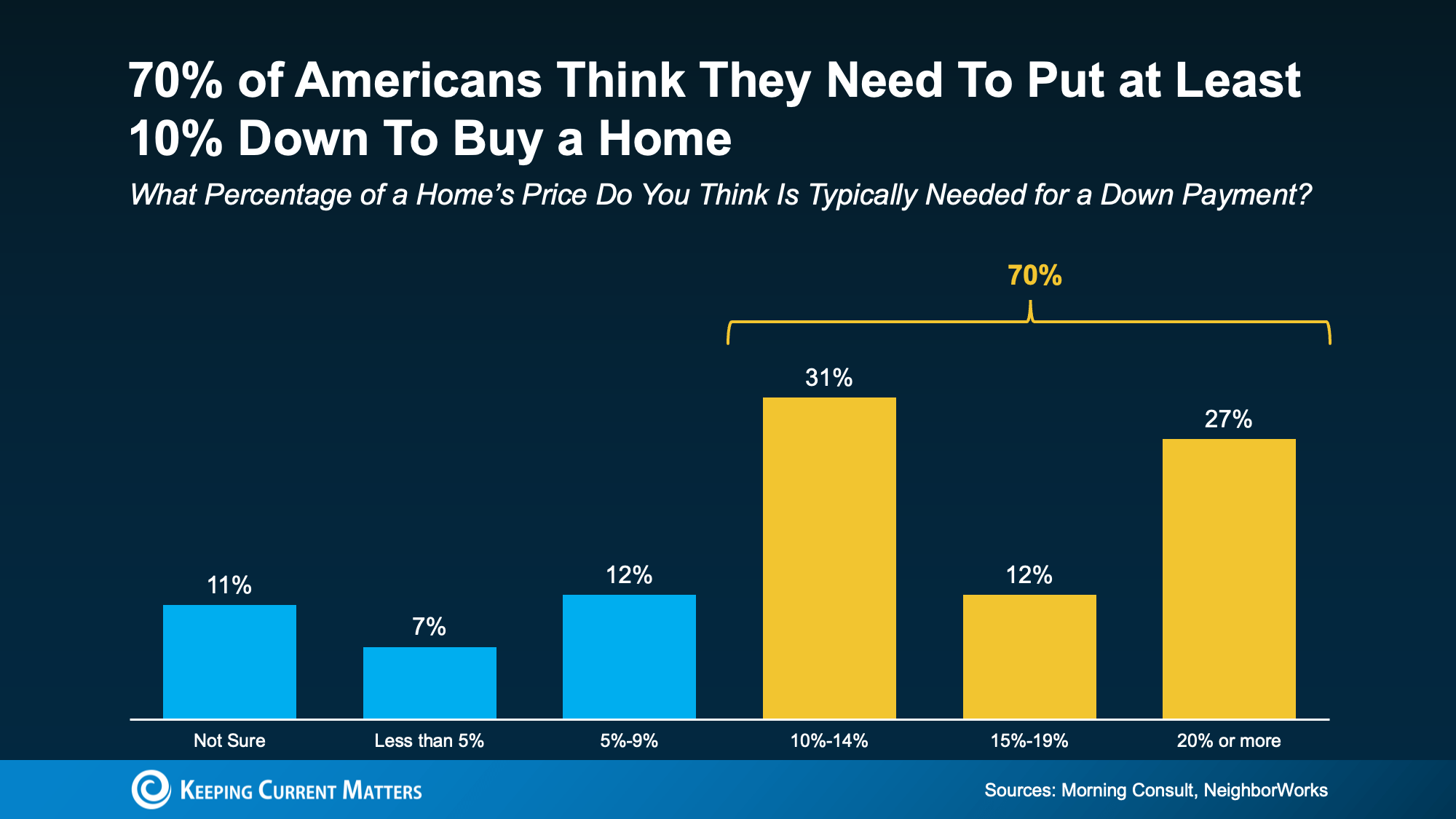

This is one of the biggest misconceptions out there. A recent poll from Morning Consult and NeighborWorks shows:

70% of Americans think they need at least 10% down.

11% aren’t sure what’s required at all.

📊 [Insert graph of poll results]

The truth: According to the National Association of Realtors (NAR), the typical down payment for first-time buyers has been between 6% and 9% since 2018.

And depending on the loan type, it could be even less:

FHA loans: As little as 3.5% down

VA loans: Often no down payment required

That’s a huge difference—and it opens doors for many buyers who thought they couldn’t qualify.\

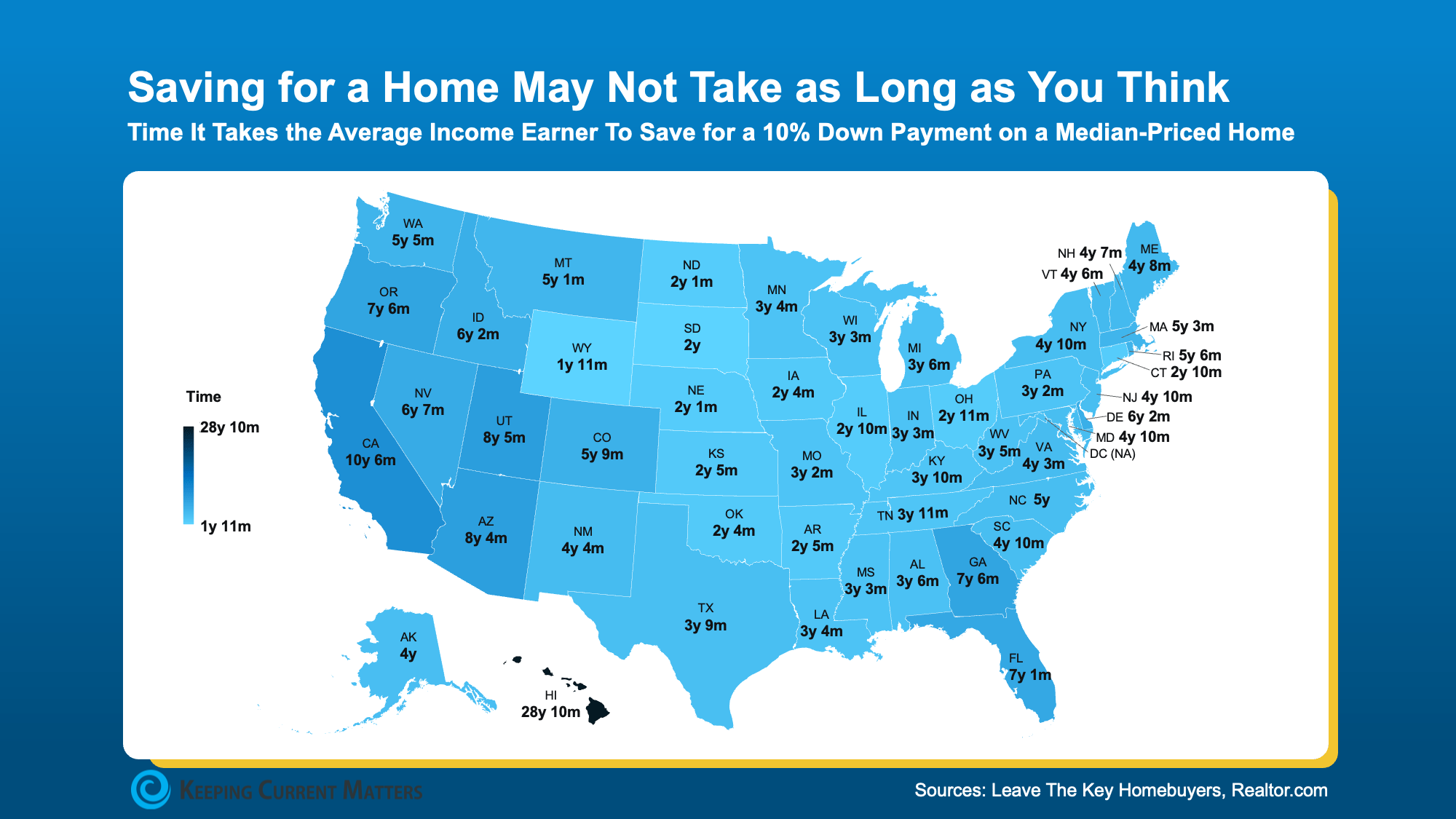

Myth 2: “It’ll take forever to save up for a down payment.”

Yes, saving takes effort. But it may not take as long as you think. A new study shows the time it takes to save for a 10% down payment varies widely by state, based on home values and income levels.

📍 [Insert map showing average years to save for 10% down by state]

Here’s the thing: most buyers won’t need to hit that full 10% target. With lower down payment loan options available, your timeline could be much shorter.

And remember—you don’t have to save it all on your own. Which brings us to the next myth…

Myth 3: “I have to do it all on my own.”

This one couldn’t be further from the truth. In reality, there are thousands of down payment assistance programs available across the country. But according to the same poll, 39% of people don’t even know these programs exist.

That means many buyers may already be closer to homeownership than they realize.

As Miki Adams, President at CBC Mortgage Agency, explains:

“With high interest rates and soaring home prices, down payment assistance is more essential than ever.”

These programs are designed to help everyday buyers who are ready to purchase but just need a little boost to get started.

Bottom Line

If you’ve been putting off buying a home because the down payment feels overwhelming, it may not be as big of a barrier as you think.

✔️ You may not need as much as you’ve heard.

✔️ Assistance programs could help cover part of it.

✔️ A trusted real estate agent can point you toward the right resources.

💡 Don’t let myths keep you from your goals—connect with a local agent today to learn what’s really possible for you.