Blog

What Credit Score Do You Really Need To Buy a Home?

🤯 Let that sink in: most homebuyers think they need better credit than they really do. And that misconception might make you feel like buying a home is out of reach when it may not be.

Let’s break down what the data actually says about credit scores and homebuying.

There’s No One Magic Number

Here’s the truth: there isn’t one universal credit score you have to hit to buy a home.

Every lender has its own standards and risk tolerance. As FICO explains:

“There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

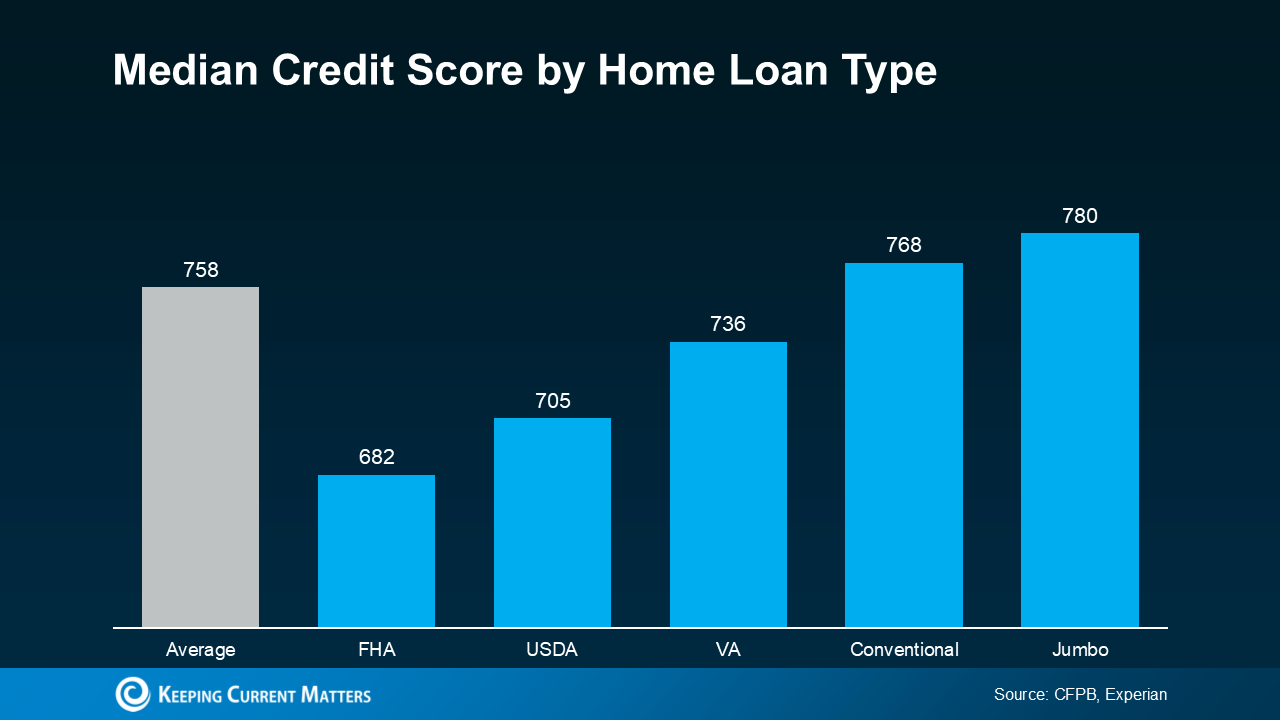

That means the “perfect” number you’ve been worrying about may not even exist. The reality? Median credit scores for recent buyers vary depending on the type of loan they used.

This flexibility could open doors you thought were closed. The best next step is to talk to a trusted lender who can walk you through your specific options.

Why Your Score Still Matters

Even though there’s no one-size-fits-all cutoff, your credit score does play a big role. Lenders use it to measure how reliable you are with money—things like paying bills on time and managing debt responsibly.

Your score can influence:

✅ Which loan programs you qualify for

✅ The terms of your loan

✅ Your mortgage rate

And since mortgage rates directly affect how much home you can afford, a better score can translate into serious savings. As Bankrate puts it:

“Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

Here’s the good news: your score doesn’t need to be perfect. Many buyers are surprised to learn they still qualify for a loan, even if their credit isn’t as strong as they’d like.

Want To Boost Your Score? Start Here

If you’d like to improve your credit before buying, here are a few smart moves from the Federal Reserve Board:

Pay Your Bills on Time – This is the single most important step. Consistency shows lenders you’re reliable.

Pay Down Your Debt – Aim to keep your credit usage low. Less debt = lower risk to lenders.

Review Your Credit Report – Correcting errors can improve your score. You’re entitled to free reports annually.

Avoid Opening New Accounts – Too many applications can hurt your score with hard inquiries.

Bottom Line

Your credit score doesn’t have to be flawless to qualify for a home loan. But the stronger it is, the more likely you are to secure better loan terms and lower rates.

The best way to know where you stand? Connect with a trusted lender. They’ll review your situation, explain your options, and help you take the right steps to reach your homeownership goals.