Blog

Charlotte’s Housing Market Is Quietly Turning a Corner Going into 2026

After several years of high mortgage rates and hesitation from both buyers and sellers, Charlotte’s housing market is finally showing signs of life again. Activity is picking up. Listings are increasing. Buyers are re-engaging. And for the first time in a while, there’s a sense that the Queen City is heading toward a more balanced—and more active—market.

No, we’re not seeing a dramatic surge. But we are seeing a meaningful shift. One that could set the stage for a noticeably stronger year in 2026.

Here are the major trends driving Charlotte’s slow-but-steady comeback.

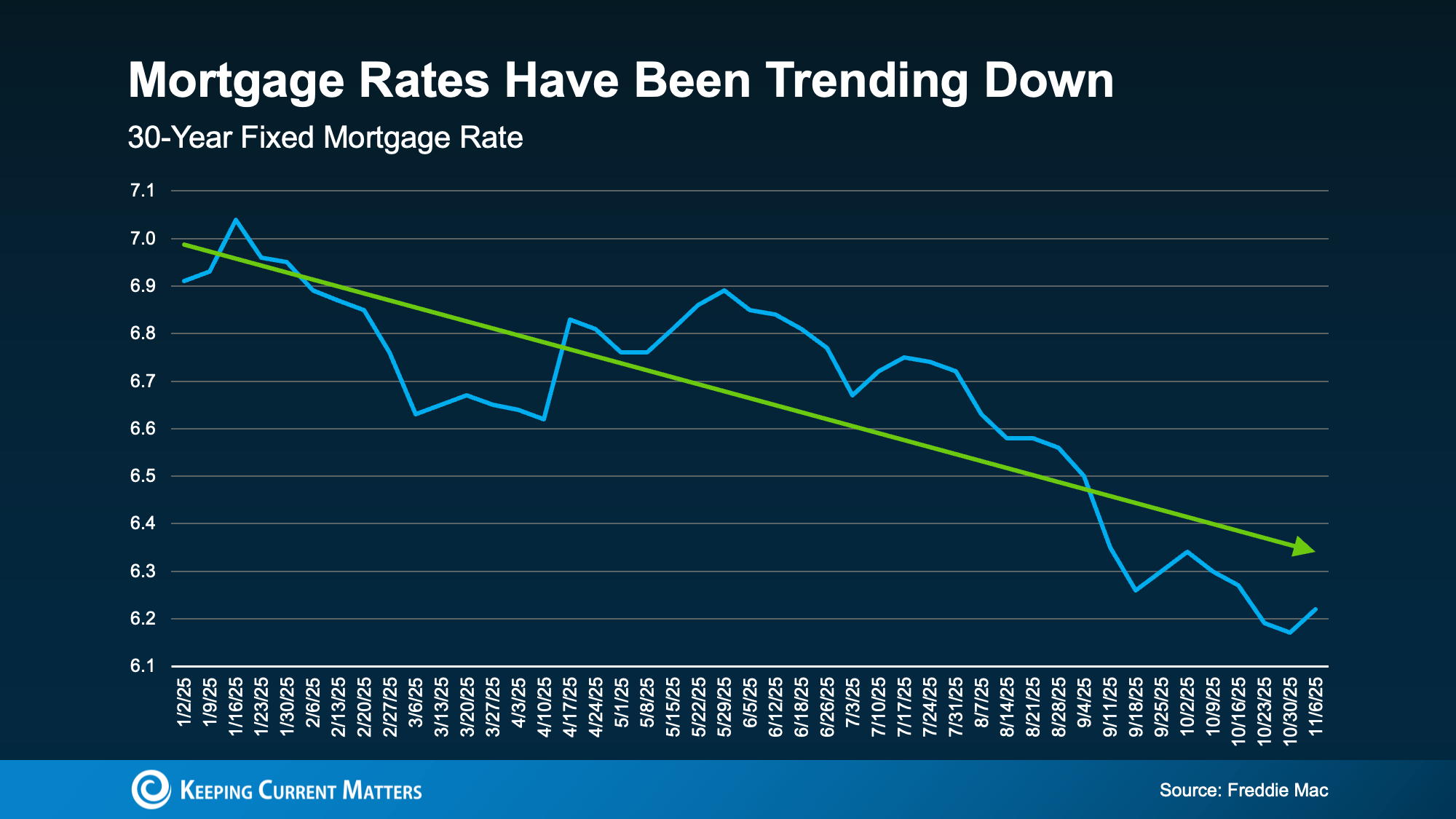

1. Mortgage Rates Are Easing—and It’s Helping Charlotte Buyers

Mortgage rates naturally move up and down, especially with the economic uncertainty of the last few years. But if you look at the broader trend, rates have generally been drifting downward for most of 2025.

And nationally, we’ve seen some of the best rates of the year in recent months.

That matters even more in a competitive market like Charlotte, where affordability has been a hurdle since the pandemic boom years. Lower rates mean more buying power—sometimes a lot more.

For example:

A buyer with a $3,000 monthly budget can afford around $25,000 more home today than they could one year ago. That difference opens doors for buyers who were previously priced out of popular Charlotte areas like South End, Plaza Midwood, and Ballantyne.

Simply put: improving affordability is helping buyers step back into the market, and Charlotte is feeling the impact.

2. More Charlotte Homeowners Are Finally Ready to Sell

For years, the “golden handcuff” of ultra-low pandemic mortgage rates kept homeowners locked in place. Charlotte felt this especially hard—inventory fell to some of the lowest levels in the Southeast.

But now, as rates normalize, more Charlotte homeowners are deciding to move for lifestyle reasons:

Growing families moving to the suburbs (Huntersville, Matthews, Fort Mill)

Empty-nesters downsizing from larger homes in South Charlotte

Relocations driven by Charlotte’s booming job market

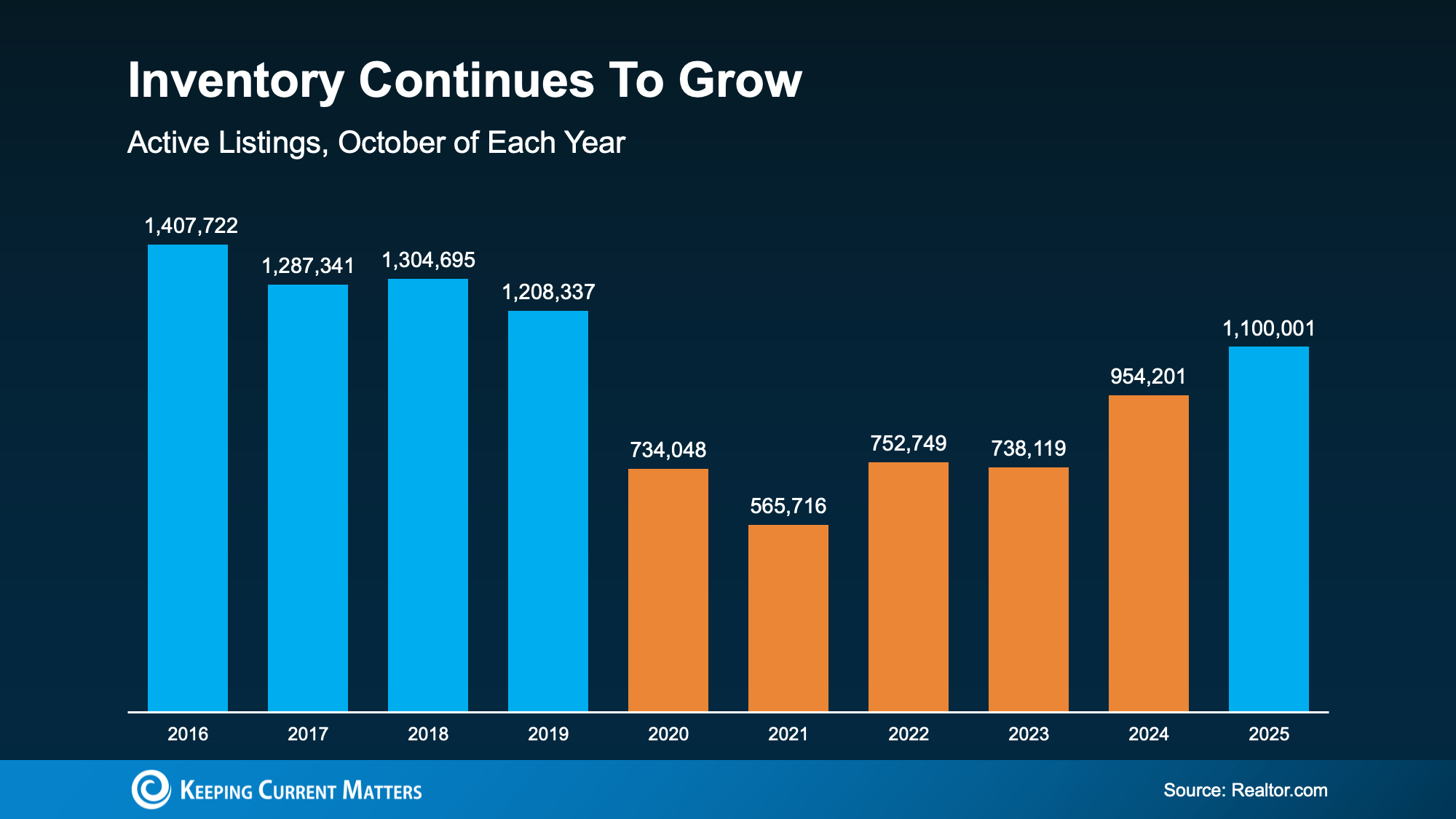

And we’re finally seeing the results: inventory is rising.

While it’s not a flood of listings, the number of homes for sale is much closer to typical pre-pandemic levels than Charlotte has seen in years.

For buyers, that means more choices and less competition than the frenzy of 2021–2022. For sellers, it means a healthier, more balanced market—not the one-sided dynamics of the past few years.

3. Buyer Activity in Charlotte Is Picking Back Up

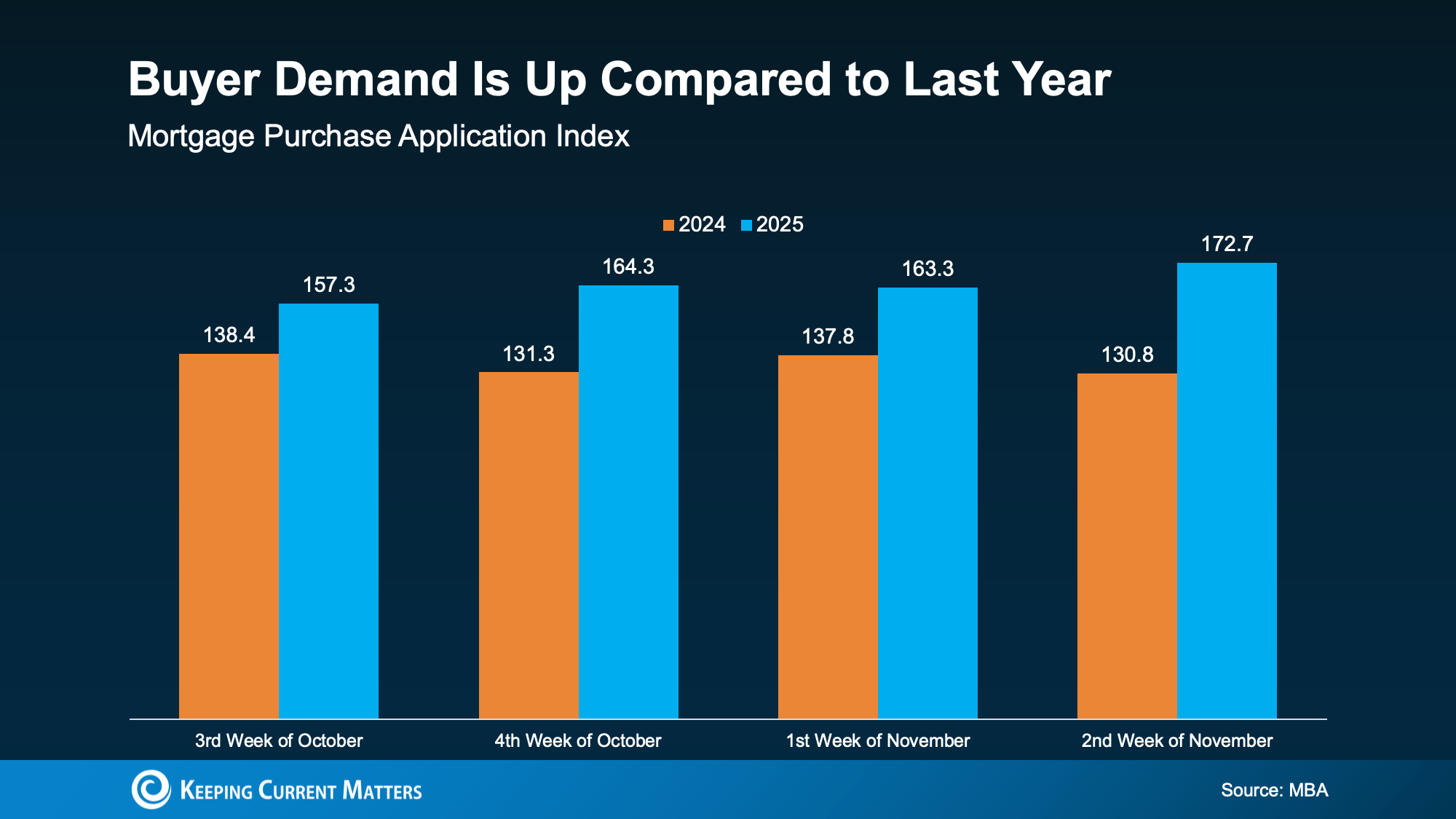

With more inventory and slightly better affordability, Charlotte buyers are re-entering the market in noticeable numbers. Mortgage purchase applications nationally are up compared to last year, and the pattern aligns with what we’re seeing locally:

More showings

More new-buyer inquiries

More homes going under contract within the first few weeks

Charlotte continues to be a migration hot spot, especially for buyers relocating from higher-cost markets like New York, New Jersey, and California. That steady inbound demand helps fuel the current momentum—and experts expect it to carry into 2026.

Economists at Fannie Mae, MBA, and NAR all forecast moderate growth in home sales next year as the market stabilizes and confidence increases.

Bottom Line

After a slower stretch, Charlotte’s housing market is finally turning a corner. Lower mortgage rates, rising inventory, and growing buyer activity are creating a healthier and more dynamic housing landscape as we head into 2026.

If you’re thinking about making a move, this could be the turning point you’ve been waiting for. Connect with a local Charlotte real estate expert who can help you navigate what’s changing—and position you to make the most of the shifting market.